Relying solely on spreadsheets leads to errors and limited visibility into key metrics. That's why you need a FinTech stack purpose-built for B2B SaaS.

Managing the financial operations of a fast-growing SaaS business is no easy feat, especially when you have a small finance team. From billing and revenue recognition to planning and forecasting, there are countless processes that need to be tracked in order for a company to scale efficiently. However, relying solely on spreadsheets often leads to scattered data, manual errors, and limited visibility into key metrics.

That's why savvy SaaS operators are turning to purpose-built finance technologies like Jirav and Maxio to achieve efficient growth and streamline their financial operations. In a recent webinar, our team at Maxio met with Jirav to discuss the challenges facing small finance teams and how our two platforms can help them build a more efficient Finance function in their business.

Our panel included:

- Adrianna Hardin, Senior Director of Support and Services at Jirav

- Andrea Wunderlich, Director of Product Marketing at Maxio

- Shilpa Mohan, Head of Operations at ProcurePro

Here’s what we learned:

The challenges of managing finance with a lean team

"Finance team of one, that's me," laughed Shilpa from ProcurePro. As the sole finance lead for a 40-person company operating globally, she epitomized the small-but-mighty finance team. In a poll taken during the webinar, a staggering 43% of attendees also indicated they had just one person handling Finance.

For these slim teams, relying on manual processes poses significant challenges:

- No single source of truth. Data easily becomes fragmented across disconnected spreadsheets, and critical information gets lost in the mix. No real-time visibility means you can't access accurate metrics like MRR or ARR on demand.

- Difficulty scaling. Adding new product lines and customer segments increases complexity beyond what spreadsheets can handle.

- Limited forecasting. Manual processes make modeling your growth trajectories and cash runway nearly impossible.

- Revenue leakage. Lack of automation in your AR and AP processes means missed invoices and billing errors are common.

- Reporting headaches. Creating investor-ready materials is both time consuming and error prone.

"There's a real risk that if you're working in spreadsheets, you're never looking at a single point in time. You're stuck in the weeds trying to update week by week without ever seeing the full picture," Shilpa explained. Without centralized systems, data easily becomes fragmented.

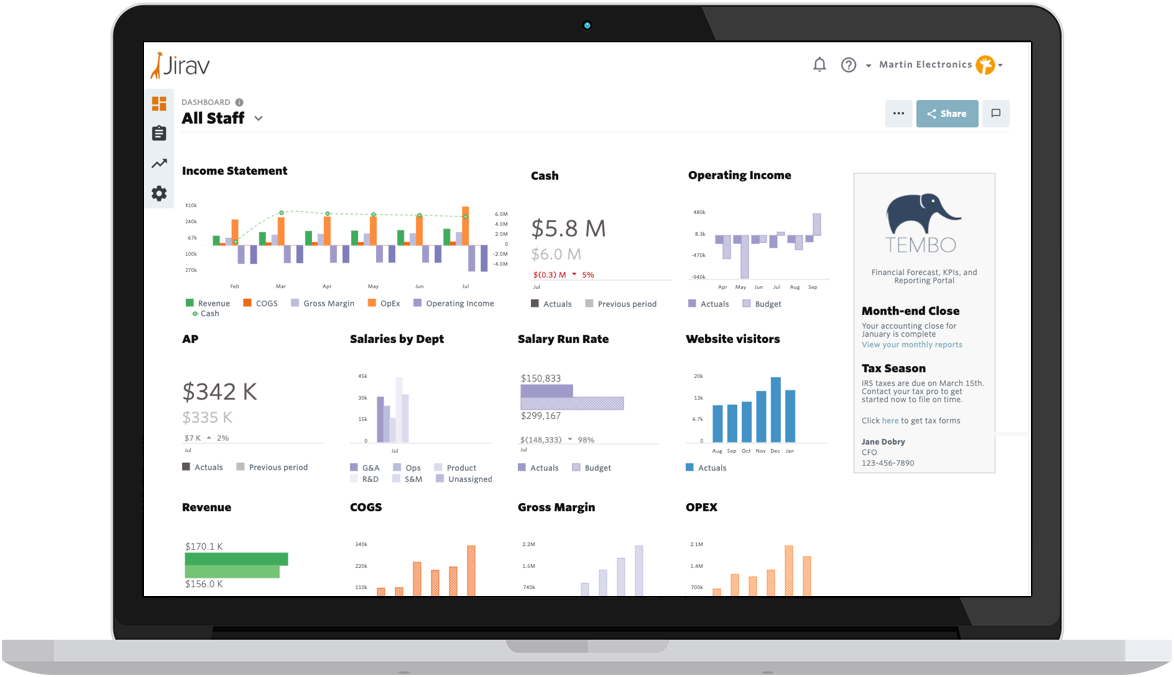

(Click here to see an enlarged version of the image)

This pain only deepens as companies add products, customers, and business complexity. "As you get bigger, the problems get bigger," said Andrea from Maxio. Missing renewal invoices, complex revenue recognition needs, and trouble scaling pricing models were just some of the issues she commonly saw companies run into as they grew.

Making the leap from spreadsheets to software

Yet, despite the headaches spreadsheets cause, many lean finance teams hesitate to adopt dedicated financial systems. In our webinar poll, over 50% of attendees said they still use spreadsheets for billing, revenue metrics, and other financial operations. Why the resistance to upgrading processes?

Cost and current workload are two primary factors for upgrading financial systems, the panelists noted. "I totally get it. Software isn't the cheapest solution when you can still do things in spreadsheets," acknowledged Shilpa. Likewise, when your current workload feels manageable, it's hard to justify the time and effort of implementing a new system.

But there are several risks finance leaders must consider if they continue relying on makeshift spreadsheet solutions:

- Formula errors and broken links between spreadsheets become more frequent as complexity grows. If you’re manually updating financial data in spreadsheets, critical data can easily become corrupted or lost.

- Lack of automation means teams struggle to keep up with manual processes as transaction volume increases.

- Spreadsheets often become siloed. There's no single source of truth, hindering leaders from getting an accurate big-picture view of the business.

- Custom logic in spreadsheets is rigid and hard to change. This makes it difficult to scale pricing, billing, and reporting needs across geographies, business units, and products.

- Little or no audit trail of changes made to spreadsheet data, formulas, or reports means the accuracy of your spreadsheets often comes down to institutional knowledge.

- Forecasting, cohort analysis, etc., becomes time consuming or impossible. This makes it difficult to answer key questions from stakeholders without extensive manual work.

So, when should you make the leap to dedicated finance software? Our experts agree it pays to think ahead.

"Whatever feels manageable now, you've got to think about where you'll be in 12-24 months," advised Andrea. When you project out your forecasted customer and revenue growth, you need to keep in mind that your current spreadsheet processes will quickly break as you scale. Relying on manual processes like these is what makes scaling so difficult.

In short, it’s better to preemptively invest in scalable technology upfront. That way, you avoid reactionary Band-Aid solutions down the road, as your business’s complexity outpaces your finance team's capabilities.

ProcurePro's powerful combo: Maxio + Jirav

ProcurePro didn't want to risk outgrowing spreadsheets. From their earliest days, they implemented SaaS solutions to manage their finances, starting with Maxio for billing, revenue recognition, and subscription management.

"We knew from the get-go we wanted to use software," said Shilpa. Relying on manual processes would mean that ProcurePro's leaders would never have had an accurate handle on critical SaaS metrics like their MRR and ARR, making it difficult to convey performance to investors. Maxio gave them real-time visibility into these numbers.

Here’s how Maxio was able to help:

- Automated global subscription management and invoicing with flexible billing options

- Advanced revenue recognition capabilities to handle complex multi-year contracts

- Milestone-based project modules that aligned revenue recognition with their sales cycle

- Detailed reporting on MRR and other SaaS metrics to prep for investor conversations

To further mature their finance stack, ProcurePro also used Jirav for planning, budgeting, and analytics. Now, they could marry Maxio's accurate historical data with Jirav's forecasts and models to gain even more visibility over their business’s performance.

Jirav enabled them to:

- Create insightful models and forecasts leveraging real-time data from Maxio

- Report and analyze financial performance and cash flow in real-time

- Extend their cash runway by optimizing payment terms based on data insights

- Reduce budgeting and reporting workloads for their lean Finance team

- Publish Reporting Packages for board and investor meetings

"Closing our books each month takes maybe two hours now," revealed Shilpa. Now, instead of being bogged down by manual reporting, she and her team can analyze performance and cash flow in real time with Jirav's dashboards. This insight enabled ProcurePro to recently tweak their payment terms with a surprising result:

"We extended our runway by six to eight months," said Shilpa. By taking advantage of SaaS tools like Maxio and Jirav, they were able to make a huge impact on their financial performance with minimal effort.

Overcoming the scale-up bottleneck

Unfortunately, many growing SaaS companies will hit hard limitations trying to manage financials with entry-level tools and institutional knowledge. "It creates this phenomenon we call the scale-up bottleneck," said Andrea. This phenomenon explains why growing companies are struggling to measure SaaS metrics and improve their financial operations.

Symptoms of an impending bottleneck include:

- Heavy reliance on complex, easily broken spreadsheets

- Constant scrambling for answers to critical questions

- Inability to provide investors with detailed metrics and cohort analysis

- Revenue leakage from missed invoices and billings

"This is when you're failing audits, taking valuation haircuts, and disrupting M&A," said Andrea. The business consequences of shaky financial operations grow more severe over time.

For example, a lack of accurate revenue recognition and billing management means most companies will struggle to provide investors and board members with detailed monthly recurring revenue cohorts by customer segment. In this scenario, leadership teams will constantly be guessing at churn risks rather than having clear visibility into what’s actually happening in their business. Similarly, critical questions about how pricing changes may impact subscription renewals will go unanswered due to poor reporting capabilities.

And that’s not all. When you rely on manual tools like spreadsheets, gaps in your order-to-cash processes will lead to missed billings and invoices, resulting in substantial revenue leakage quarter after quarter. Attempts to model growth trajectories and cash runways will also be nearly impossible without a single source of truth for key metrics. The end result is frustrated investors, failed audits, and stalled growth for your business.

However, modern platforms that are purpose-built for SaaS companies can bust through these barriers. By unifying your order-to-cash processes and connecting your actuals to forecasts, they give you the visibility, flexibility, and controls needed to scale smoothly.

For instance, with Maxio and Jirav, SaaS businesses gain access to pre-built reports, dashboards, and visualizations that provide clear insight into MRR cohorts, customer health, pricing analytics, and more. Forecasting, budgeting, and scenario modeling also become simple when real-time data flows automatically between the platforms. As Shilpa put it, "I can spend time looking at what the numbers are telling us versus focusing on manual work."

And most importantly, by automating repetitive tasks, you can empower your finance team to focus on high-impact strategy and planning instead of toiling away in spreadsheets.

Is It the Right Time to Upgrade Your Finance Tech Stack?

Ready to reevaluate your tech stack? Here’s how our panelists recommend you overhaul your financial tech stack step-by-step:

1. Document your current pains: Where do spreadsheets and manual processes bog you down? What questions keep you up at night? Track these pains to build your case for change.

2. Map out your future needs: Factor in projected growth, potential business model shifts, and new product lines. What potential challenges lie ahead in 12-24 months? How could technology help you scale?

3. Model the benefits: Calculate how much time and money tech could save you, plus the opportunity cost of delayed decisions or insights. You should also quantify the revenue risk of billing errors and missed invoices.

4. Start small, think big: You don't need to overhaul everything at once. Start with foundational platforms like your billing and metrics. But choose flexible solutions that can expand as you grow–investing in enterprise tools like an ERP could lead to unnecessary tech debt.

5. Invest in implementation: Don't just plug in software and call it done. Set it up for long-term success by meticulously configuring it to your needs from the start.

Following ProcurePro's lead, combining Maxio's order-to-cash capabilities with Jirav's planning and analytics can create a formidable finance tech stack for your business. But smart finance leaders know successful adoption requires much more than just purchasing software.

If you’d like to learn how other B2B SaaS leaders are overhauling their billing and invoicing, check out the recent Maxio Institute Report. You can also schedule a demo with our team or discuss with your Jirav customer success manager how you can bring in data from other parts of your tech stack in to Jirav for efficient, scalable growth.