We're in uncharted waters.

To combat the extraordinary economic impact of COVID-19, the U.S. government has passed a series of bills aimed at ensuring income for workers, aiding medical facilities, and keeping businesses operational. The historic “Phase 3” will pump $2 trillion into the economy. $349 billion of that is earmarked for small businesses through loan programs.

Small businesses have two primary channels for claiming this money — The Economic Injury Disaster Loan (EIDL) and the Payment Protection Program (PPP).

In this article, we’ll cover:

- An overview of both the EIDL and the PPP

- What it takes to get loan forgiveness

- The latest updates to the programs

Prefer to listen rather than read? Watch our on-demand webinar with ProvenCFO for additional information and analysis beyond the basics:

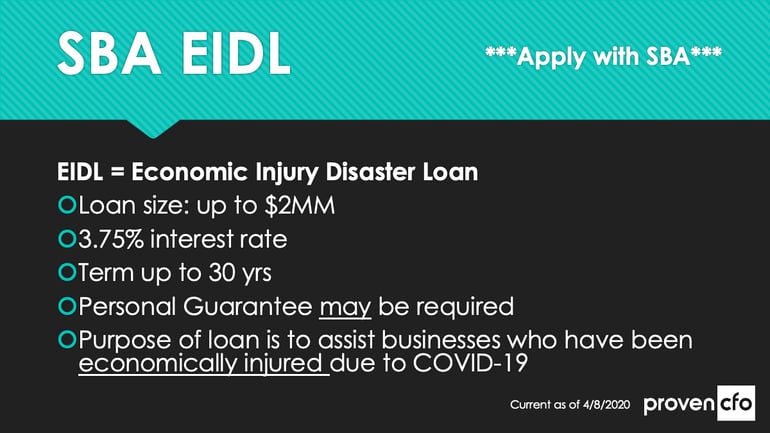

The Economic Injury Disaster Loan (EIDL) program

Intended for disasters which temporarily damage local economies, the EIDL has significantly expanded due to the pandemic. There are two parts of this loan with a single application: An advance of up to $10,000 and the loan itself of up to $2 million.

The EIDL Advance

While there is a single application process, there are two parts to the EIDL. The first in an advance of up to $10,000. The amount and eligibility for this advance is determined by the SBA. While the SBA website claims a decision within a few days, it’s likely to be longer due to the large volume of applications.

If the advance is granted, it doesn’t have to be repaid in the overwhelming majority of cases. Exceptions to this policy include misspending funds and knowingly giving false information during the application.

The EIDL Loan

If you’re approved for the advance, an SBA lender may be in contact to collect other details and determine the amount of the actual loan. The maximum amount of a loan is $2 million with an interest rate of 3.75%. The term is variable up to 30 years. Loans above $200,000 will likely require a personal guarantee.

Who’s Eligible for an EIDL?

According to the SBA, “This program is for any small business with less than 500 employees (including sole proprietorships, independent contractors and self-employed persons), private non-profit organization or 501(c)(19) veterans organizations affected by COVID-19.”

The application process is fairly straightforward. You will need to know some details such as:

- Your revenue for 12 months prior to January 31st, 2020

- Cost of Goods Sold

- Basic business details regarding what it is your organization does

Further Reading: The SBA provides a detailed PDF with answers to frequently asked questions.

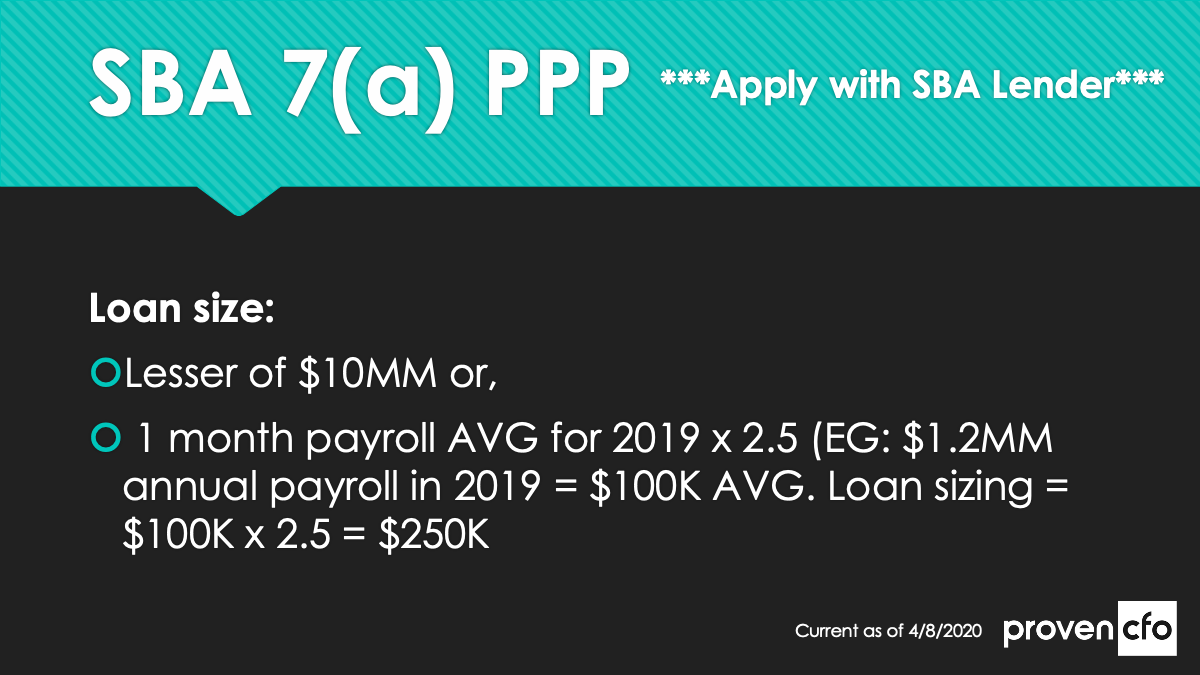

The Paycheck Protection Program (PPP)

It’s the Paycheck Protection Program (PPP) that’s getting the bulk of the media attention. At the time of writing, the Small Business Administration has allocated more than $100 billion of the initial $350 billion in approved funds. Republicans in Congress want to add a further $250 billion to the program, but efforts have stalled.

It’s the Paycheck Protection Program (PPP) that’s getting the bulk of the media attention. At the time of writing, the Small Business Administration has allocated more than $100 billion of the initial $350 billion in approved funds. Republicans in Congress want to add a further $250 billion to the program, but efforts have stalled.

The PPP is intended to keep the American workforce on the payroll of businesses across the country. Unemployment has exploded to levels never before seen and this program is for employers to keep their team out of the unemployment insurance program, if at all possible.

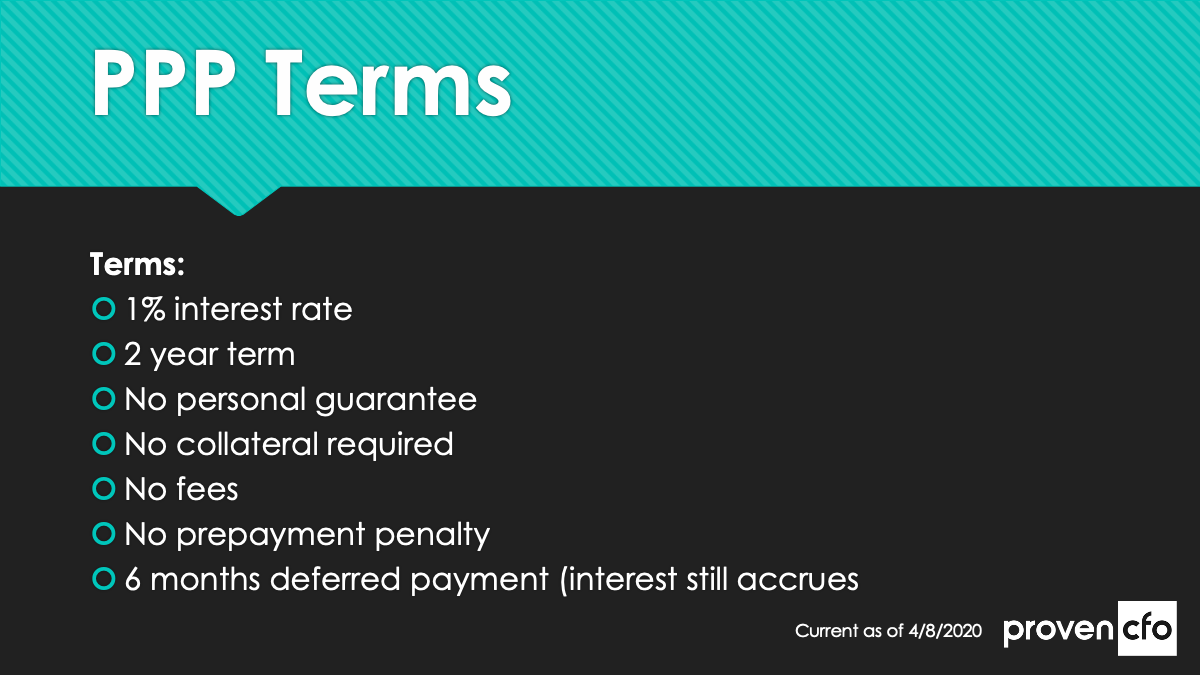

PPP Loan Details

Loan values are calculated by taking an average month’s payroll from 2019 and multiplying that by 2.5. The cap on the loan amount is $10 million.

Loan values are calculated by taking an average month’s payroll from 2019 and multiplying that by 2.5. The cap on the loan amount is $10 million.

Any funds MUST be used for ONLY:

- Payroll costs

- Mortgage interest

- Rent

- Utilities

Important: Non-payroll costs (mortgage, rent, utilities) must not exceed 25% of the loan amount. For example, if your loan is for $400,000, at least $300,000 must go toward payroll costs.

Further Reading: The Treasury department put together this PDF of frequently asked questions along with their answers.

Payment Protection Program Forgiveness

If the PPP funds are used as intended, the entire amount will be forgiven. But how an organization spends the money isn’t the only requirement for loan forgiveness. Some other requirements include:

- Number of staff: If the full-time employee headcount is reduced, the level of forgiveness may also be reduced.

- Level of payroll: Don’t decrease salaries more than 25% for employees who made less than $100,000 in 2019.

- Re-hiring: Full-time employees and salary levels back to the same level as 02/15/2020 by 06/30/2020.

PPP Loan Eligibility

According to the Treasury department, “All businesses – including nonprofits, veterans organizations, Tribal business concerns, sole proprietorships, self-employed individuals, and independent contractors – with 500 or fewer employees can apply.”

Applying for a PPP Loan

While businesses apply for the EIDL directly through the Small Business Association, PPP loans are handled through the thousands of SBA-approved lenders, which are mostly banks.

In order to apply, you will need to have certain information available for the application process including:

- Average monthly payroll

- Number of employees

- Certain legal and financial questions

The application is relatively straightforward and takes about an hour to complete if you have access to your payroll records, payroll tax filings, and business and owner legal documents.

Note: As of April 10, those self-employed and independent contractors are also allowed to apply for a PPP loan.

Deciding the Best Course of Action

Businesses are able to apply for both an EIDL and a PPP loan. Applying for one, both or neither of the loans is a matter of discretion. An EIDL loan seems to come with fewer restrictions. However, the dollar amount is typically lower than the PPP.

Things to consider:

- Whether or not you are able to meet forgiveness requirements (including those to have your full staff back by the summer).

- How much money you need to weather the current crisis

- Whether or not you need loan assistance

We hope you found this information helpful! Once you’ve applied, the next step is to make sure you’ve got a business plan that allows you to use the funds to weather the coronavirus storm. One thing that can help is a driver-based financial model. Request a demo and learn how Jirav can help you forecast more accurately so you know exactly what resources your business needs.

Thank you to Jirav partner ProvenCFO for your insights on our recent webinar (watch on-demand), which we leveraged to write this article.