Accountants who are elevating their value are moving from hindsight to insight and foresight.

To do that, you need a monthly deliverable that accomplishes three things:

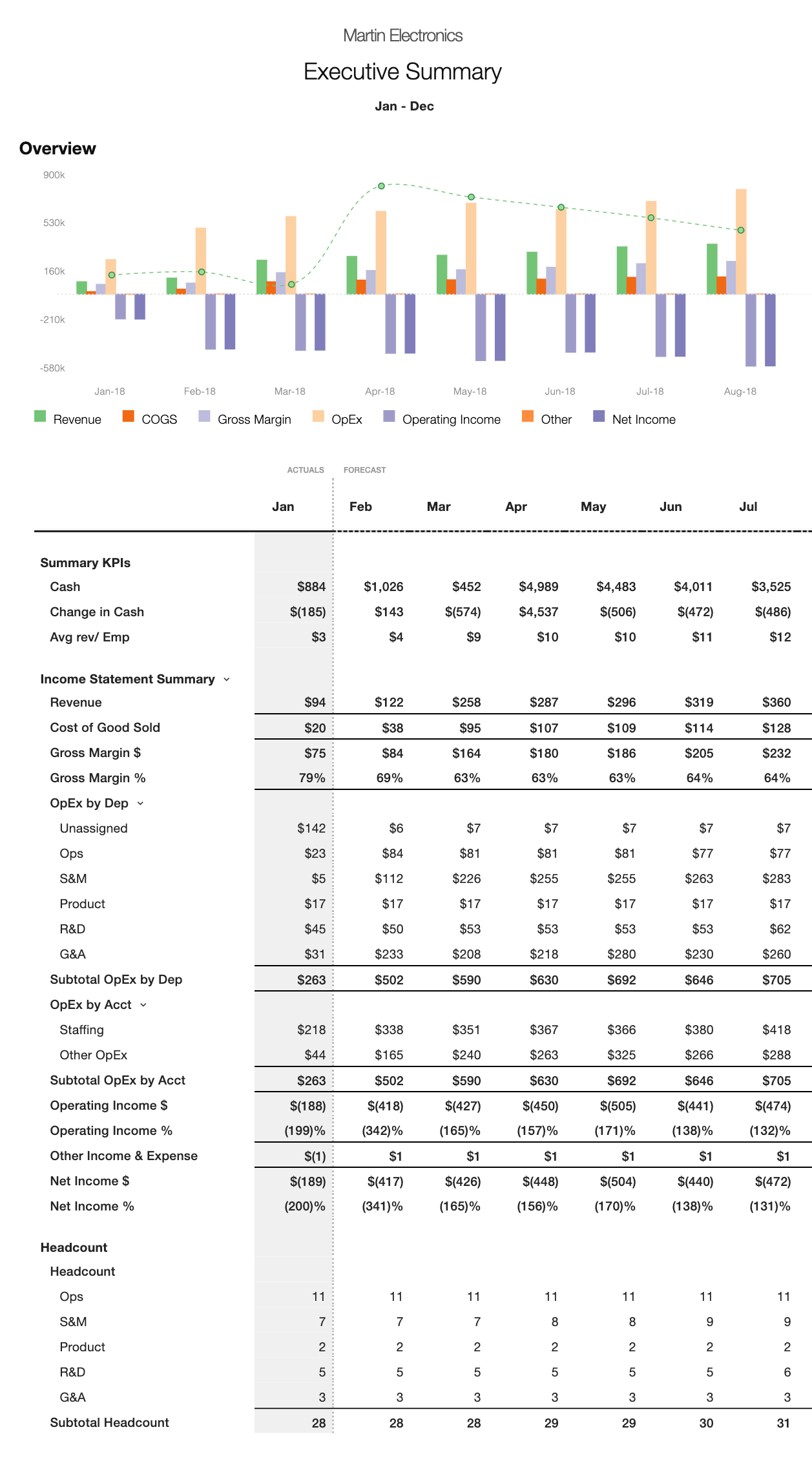

- 1. Is easy to understand at a glance

- 2. Shows clearly where the business stands

- 3. Forecasts where the business is headed

Enter driver-based planning.

What is driver-based planning?

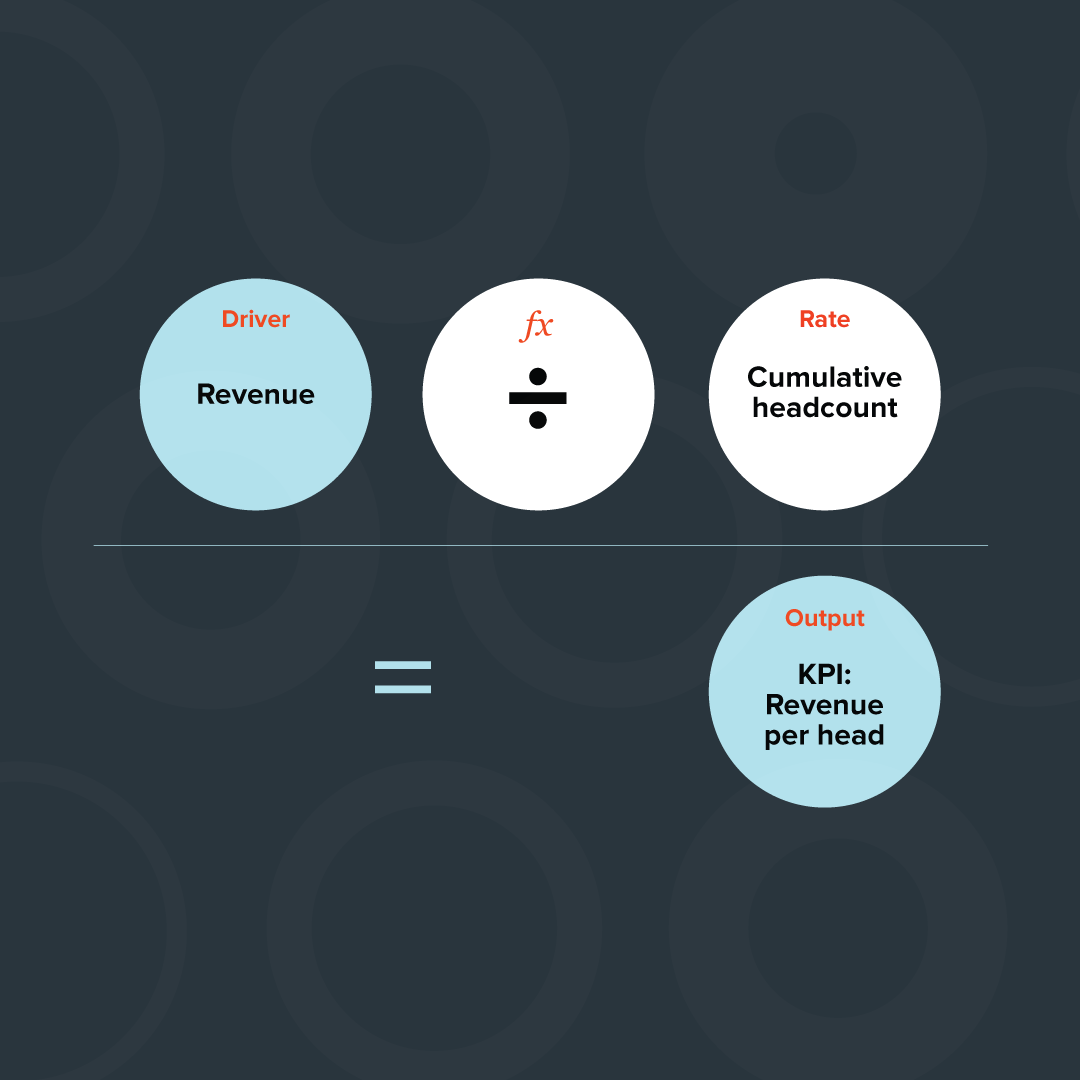

Driver-based planning is a method of forecasting that focuses on the key drivers of business results. This is different than key performance indicator (KPI) reporting, which is also a crucial component of financial modeling.

Think of it this way: Your stakeholders have goals. Key results must be achieved for the goals to be met. These key results are the KPIs that must be tracked. The drivers are the activities that must occur to hit those targets.

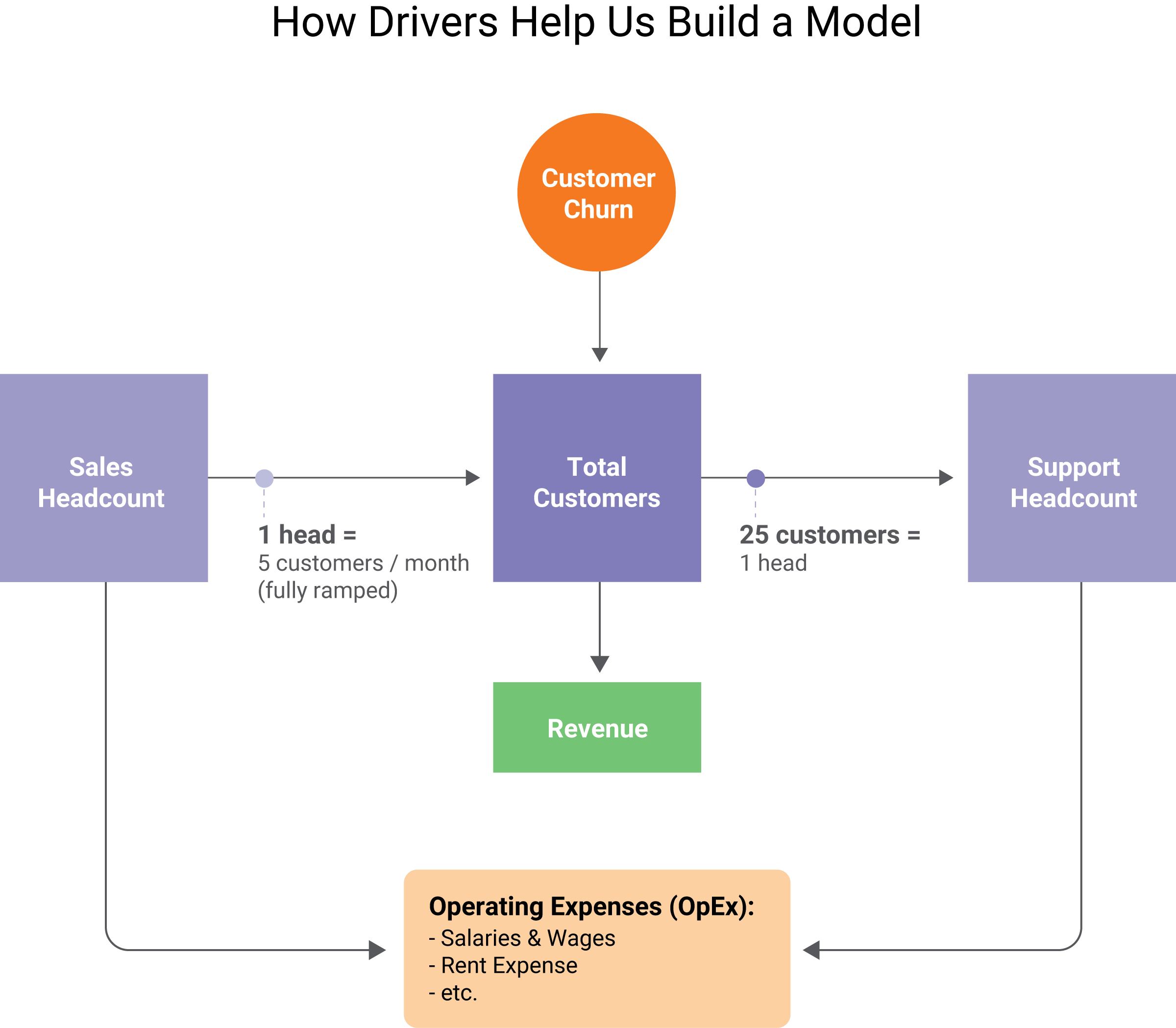

Driver-based planning is important because it emphasizes the relationships among the financials, operational results, and people. Metrics don’t exist in isolation on the financial statements; they are determined by causes and effects within the entire business.

Driver-based planning in action

Once you’ve identified your goals, the next steps are to identify the key drivers and build a financial model to reach those goals.

Your model can start with the actual numbers from a set time period, such as the last six to 12 months. That gives a starting point to see what would have to change to reach the objective. This will bring to light certain drivers that, if changed, could have a major impact throughout the entire business.

For example, you might think of the cost of acquiring a customer (CAC) as purely a marketing metric. However, CAC also has an indirect impact on the staffing plan. And spend drives more sales, potentially leading to a greater need for support staff on the operational side of the company.

The point is that when planning, you need to have a model that ties these numbers together. It’s extremely helpful to be able to determine what resources are needed if CAC is better or worse than expected. The same is true for a variety of other metrics. Your typical financial forecast can’t do that.

How to use driver-based planning

Driver-based planning offers a plain-language method of communicating with your stakeholders. They will have goals, and probably have a sense of what has to happen to achieve the goals. They also probably have assumptions for activities that might help them get there.

You become an extremely valuable asset when you’re able to break down — in simple terms — what causes the effects they are looking for. With the right model, a business is like a machine, with levers to pull to generate a result.

Compare that level of clarity to a traditional set of financial statements, which most business leaders hardly look at.

Drivers put goals in proper context

Adding driver-based planning to your accounting tool belt doesn’t mean you have to become a CFO who tells the CEO what to do — although it can help if that's what you're aiming for!

We can create plenty of value as accountants simply by linking our goals to data-driven financial planning and analysis. Rather than dispensing advice, the most important thing is to start by understanding what their goals are.

Many times, those goals will revolve around revenue and profit. With driver-based planning, you can contextualize the revenue and profit numbers to help a business create a plan to achieve those objectives.

For instance, if a business wants to increase its profit from 10% to 20% while maintaining its current growth trajectory, there will have to be trade-offs of some sort.

With driver-based planning, you can isolate the growth levers that are doing most of the work, and point out areas that could potentially be cut.

Use key drivers to see the big picture

Focusing on key drivers in your forecasting is useful on a number of levels. The obvious effect is greater focus. You can clearly illuminate the activities that drive the business. You can build accountability and feedback based on the tasks that absolutely need to happen.

Another less obvious effect of driver-based planning, though, is how it gives you the ability to plan at a higher level. You might think that by focusing on the specific actions, you’d get tunnel vision, but focusing on drivers has the opposite effect.

That’s because drivers are all connected. Building a forward-looking financial model allows you to run multiple scenarios to see the impact of one or more changes on the entire business. With this driver-based model, you can help stakeholders explore all their options. Now you’re being proactive instead of reactive.

Be a partner who provides clarity

A forward-looking financial model that allows for adjustments of key drivers takes days to build out in a spreadsheet. Plus, spreadsheets are prone to errors and are difficult to update.

Jirav’s driver-based financial planning tools give you a real-time look at financial projections and provide endless opportunities for testing out different assumptions and scenarios.

As an accountant, the biggest opportunity for increasing your value is by providing clarity as to where the business is headed and options for achieving different results. Driver-based financial modeling in Jirav standardizes and automates that process.

Request a demo and see for yourself!