If you work in finance, you’ve probably been asked these questions during times of crisis or economic uncertainty: Will our business survive? Do we need to pivot? Does our business model need to change?

When times are good, and graphs are trending up, you’re still approached: How can we grow faster? How do we scale? Markets can change quickly: do we have a plan in place for a worst-case scenario?

In short: finance jobs are always in-demand, no matter the market. And it’s easy to see why. CFO roles are quickly expanding to include a wider range of strategic functions that extend beyond closing the books and running forecasts. Accounting firms are expected to deliver higher-value advisory services and business-driven insights. Finance teams and professionals are at the center of every key business decision, making them an integral part of any company.

I’ve seen examples of this demand in action from both perspectives—finance pros helping businesses accelerate in times of growth, and work with less in leaner times. But when most of us think of going to our CFOs and finance teams with questions we need answered fast, we’re probably envisioning times of crisis. Let’s look at that example first.

How finance professionals help in times of crisis

When the COVID-19 pandemic first hit and the stock market crashed in March of 2020, suddenly businesses were in crisis mode. “Will we survive?” being the question at the top of everyone’s list. We saw restaurants going to delivery and curbside-only service, pivoting their entire business model. Companies that normally attended large, in-person events and trade shows were transitioning to virtual events. Business leaders had to face tough decisions regarding layoffs and payroll.

We all know the stories. But it was the finance people in the room, having these discussions, helping to solve for: How do we keep the business afloat? How do we not only survive, but keep growing amidst economic downturn? When CFOs and finance teams have strategies in place, and they’ve built the models and forecasts, they can plan for virtually any outcome.

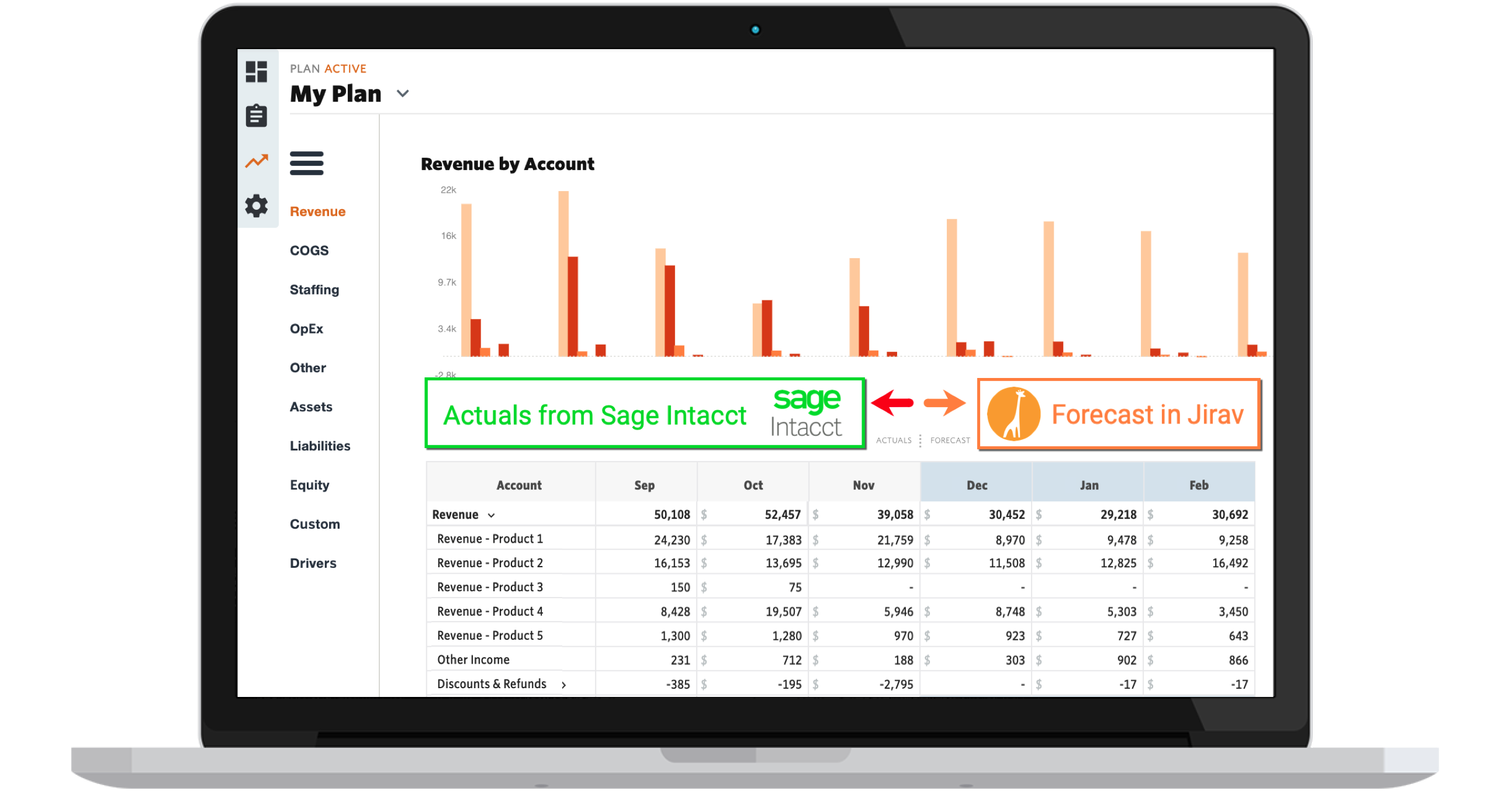

One company out of Utah – ProvenCFO – is a Jirav customer and shared with us how they approached the crisis for several of their clients. As a provider of outsourced CFO services, their clients were coming to them with similar questions to those we discussed above. Can we raise money in this environment? Can we figure out what’s going to happen to our cash flow projections? Luckily for Dave Willson, chief financial officer at ProvenCFO, they had models and forecasts built in Jirav, so they created a model called Skyfall—as in, “the sky is falling, and now we need to figure out what our new forward-looking projections need to be.”

When their clients wanted to apply for economic injury disaster loans (EIDL) in response to COVID, as well as other local grants and loans, they found that many of the applications asked for two years’ worth of monthly revenue projections. In a crisis like a global pandemic, it’s tough to be able to forecast and make projections when you’re not sure what the market will look like from one day to the next. But using the models and forecasts they’d already built, ProvenCFO was able to create the necessary financial projections for the applications by simply updating the drivers in Jirav.

And if you work for an accounting firm or a company like ProvenCFO, you know that you have to manage these types of scenarios for not only your own business, but for your clients as well. With the right strategies and technology in place, you can build models and forecasts, or update assumptions in existing plans during times of crisis in a fraction of the time it would take to build in static applications like Excel—time that most of us don’t have in crisis mode.

The strategic advantage in times of growth

On the other hand, in times of growth, finance teams may feel less pressure to deliver answers quickly, but their projections and strategies are no less important. In fact, some may argue that CFOs, finance teams, and accounting firms need to be more strategic when making plans while the company is already experiencing wins and growth.

Thankfully, in finance roles, we find ourselves in a unique position to be able to provide that kind of strategic thinking, with access to forward-looking, data-driven insights (or we should, if we’ve invested in the right FP&A technology). With models, plans, and forecasts in place, assumptions can be tweaked as markets change and our findings and shifts in the forecast can be quickly communicated to other parts of the company. So while it may not feel like a life or death situation, our strategic function is crucial in helping our organizations continue to advance in times of growth. Let’s look at a specific strategy that can be utilized in a growth scenario.

Moving forward with rolling forecasts

One strategic focal point of today’s modern finance pro is the rolling forecast. As Dave Willson from ProvenCFO mentioned, the COVID-19 pandemic’s effect on the market made it almost impossible to predict future numbers. Triggered largely by that uncertainty, rolling forecasts have become the norm in most finance groups. Rather than managing the business based on a static budget from the previous year, rolling forecasts – as the name suggests – allow you to revisit and update budgeting assumptions throughout the year.

Historical data and past results are still taken into account, but the forecast is updated on a set period established by the business, such as quarterly or monthly, so that plans may be adapted based on what’s happening in the economy, the industry, or even within the organization itself.

But it doesn’t have to be a global pandemic for rolling forecasts to come in handy. Regardless of the situation, you’ll be better equipped to respond to time-sensitive decisions with the most up-to-date numbers possible.

A multidimensional role that's always in-demand

Whether alarms are ringing and the economy’s crashing, or your organization is experiencing exponential growth, the role of the finance professional is critical to business success. Managing the books and creating budgets and forecasts are no longer the only deliverables of a CFO or finance team. Finance leaders are now shaping and driving business strategy in everything from workforce planning and culture to supply chain resilience and technology investments. But even as the role expands in more strategic directions, it all starts with better financial planning.